NEWS

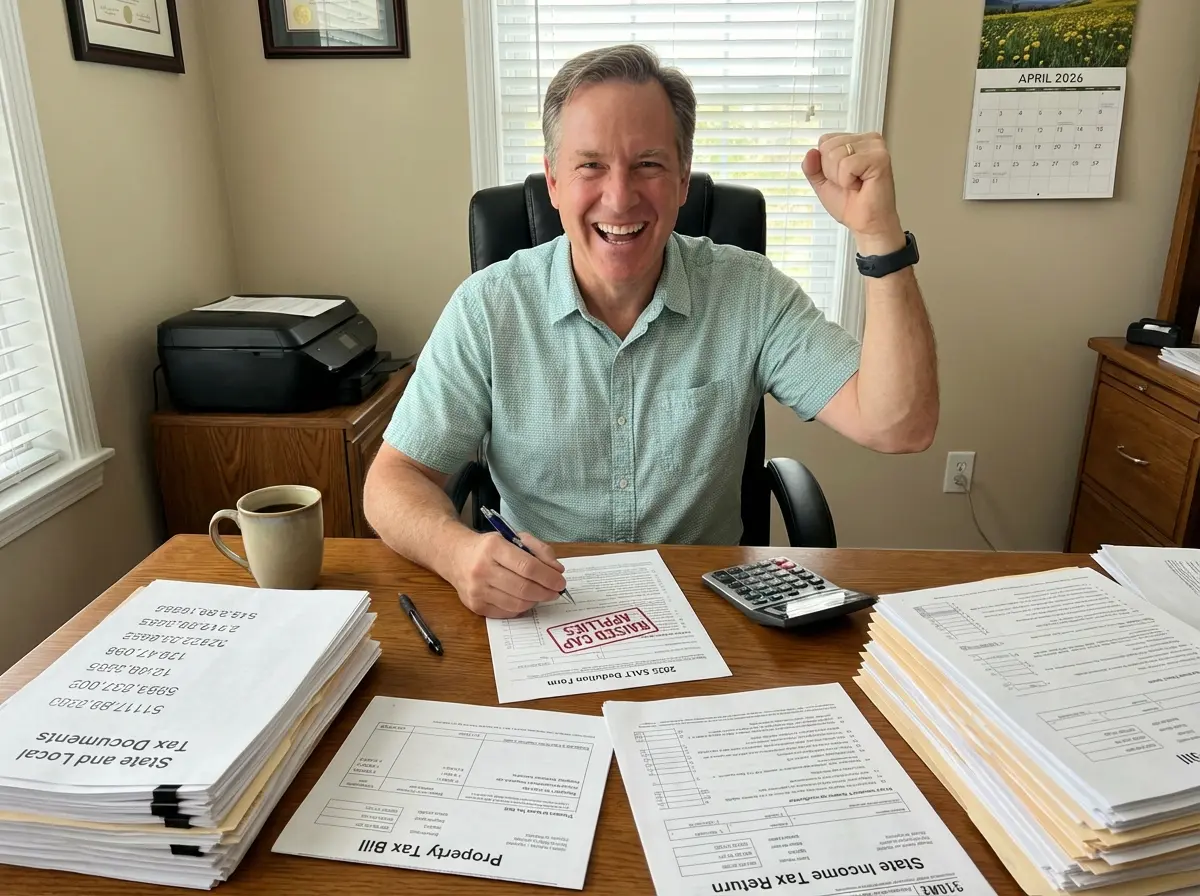

The SALT cap 2025 brings a notable change for taxpayers who itemize deductions, lifting the long-standing federal limit on state and local tax write-offs. Beginning with the 2025 tax year, eligible filers may deduct significantly more than under prior law, though income-based restrictions continue to apply.

Starting in 2025, the federal deduction cap for state and local taxes increases to $40,000 for joint filers and single taxpayers. Those who are married filing separately may deduct up to $20,000. The higher limit applies through the 2029 tax year, after which it reverts to $10,000 under current law.

The SALT deduction covers state income taxes or sales tax if elected, along with local property taxes and certain personal property taxes. These amounts are reported as itemized deductions on Schedule A of Form 1040. Federal income tax payments, payroll taxes, and homeowner association fees are not deductible.

The change was enacted under the One Big Beautiful Bill Act, a House-passed budget reconciliation measure that revised parts of the federal tax code established initially by the Tax Cuts and Jobs Act. Lawmakers described the adjustment as targeted tax relief designed to benefit taxpayers in states with higher tax rates.

Eligibility for the expanded deduction depends on modified adjusted gross income. Taxpayers with income below $500,000 may generally claim up to the full $40,000 SALT deduction limit. For separate filers, the threshold is $250,000.

Above those levels, the deduction cap phases down at a 30 percent rate. As income rises further, the allowable deduction steadily declines until it effectively returns to the prior $10,000 federal SALT cap. As a result, many higher-income households will see little change from previous years despite the higher headline limit.

The revised deduction is expected to have the most significant impact in high-tax states such as New York, where state income taxes and property taxes account for a larger share of household expenses. Some middle- and upper-middle-income households may now deduct a greater portion of their state and local tax payments.

However, taxpayers with higher earnings in those same states may see limited benefit due to the income phaseout. Analysis from the Joint Committee on Taxation indicates that the tax break is concentrated among households that itemize deductions and remain below the upper income thresholds.

Despite the higher deduction cap, taxpayers must still itemize to benefit. For 2025, the standard deduction for joint filers rises to $31,500. Filers whose total itemized deductions do not exceed that amount will not reduce their federal tax liability through the expanded SALT provision.

Mortgage interest, charitable contributions, and allowable state and local taxes are commonly combined to exceed the standard deduction. Without sufficient itemized expenses, the increased SALT deduction provides no practical benefit.

Since the expanded deduction is set to expire after 2029, tax professionals advise against relying on the higher cap for long-term planning. Some taxpayers may review the timing of estimated payments or reassess filing status to determine whether itemizing remains advantageous.

The revised rules also add complexity for self-employed taxpayers and owners of pass-through entities, who must consider how entity-level deductions interact with individual limits. Reviewing eligibility and income thresholds early can help taxpayers avoid surprises during filing season.

By William Mc Lee, Editor-in-Chief & Tax Expert—Get Tax Relief Now