20+ Years Helping Americans Resolve IRS Debt with Confidence

A bank levy lets the IRS take money directly from your bank account to cover unpaid taxes, making it more serious than a lien. Understanding your rights and relief options is key to protecting essential funds.

Tax penalties and debt can escalate quickly if ignored, but the IRS and state agencies offer relief options such as penalty reductions, settlements, and payment plans for eligible taxpayers.

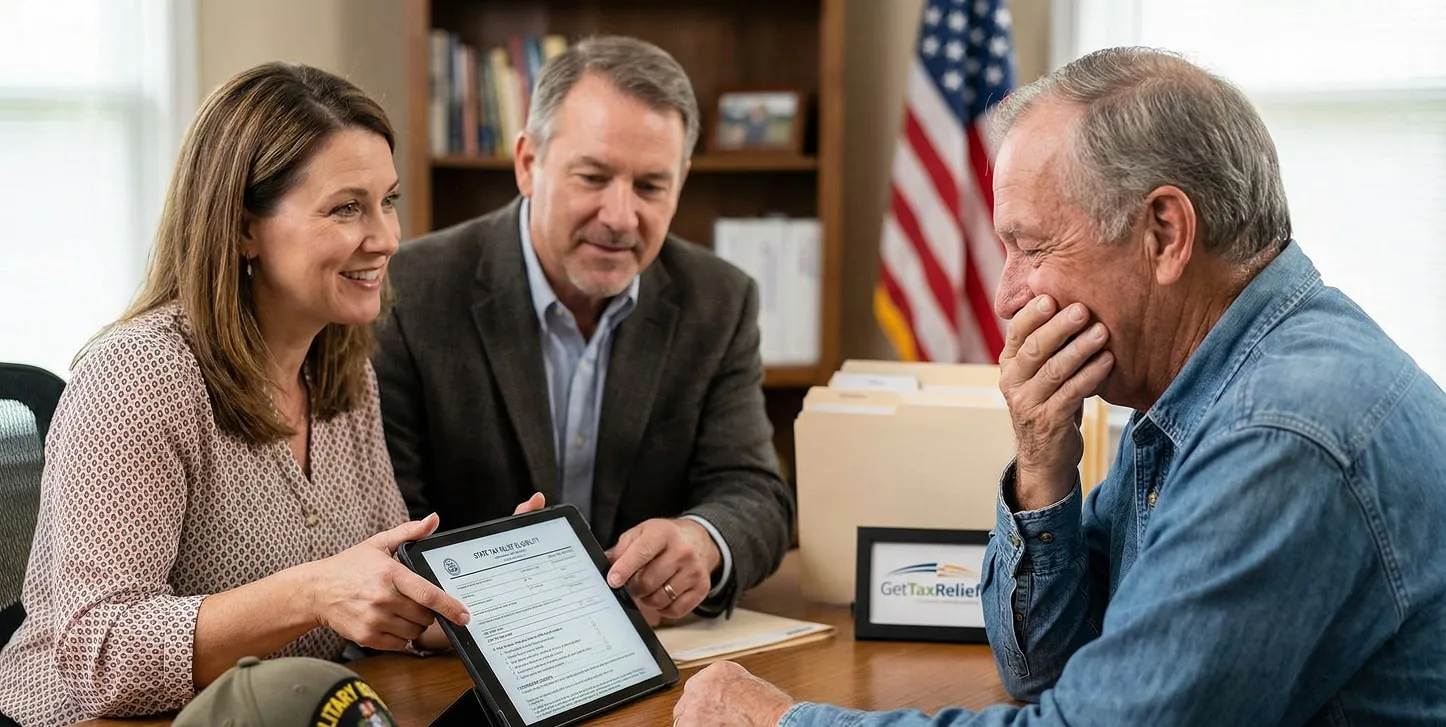

IRS CP and LT notices inform taxpayers about account issues like unpaid balances, unreported income, or return discrepancies. Each coded notice (e.g., CP504, LT11) indicates a specific problem, helping taxpayers gauge its seriousness and potential levy actions.

The IRS collection process is a structured system for recovering unpaid taxes. It begins after tax assessment and escalates through enforcement measures until the debt is resolved, paid, or deemed uncollectible. Knowing your rights, the timeline, and available resolution options is key to protecting assets.

The IRS Form Help Center provides resources to simplify federal tax filing. It explains forms, instructions, and deadlines clearly, reducing stress and confusion. Whether you need a specific form or step-by-step guidance, the center helps taxpayers approach tax season with confidence.

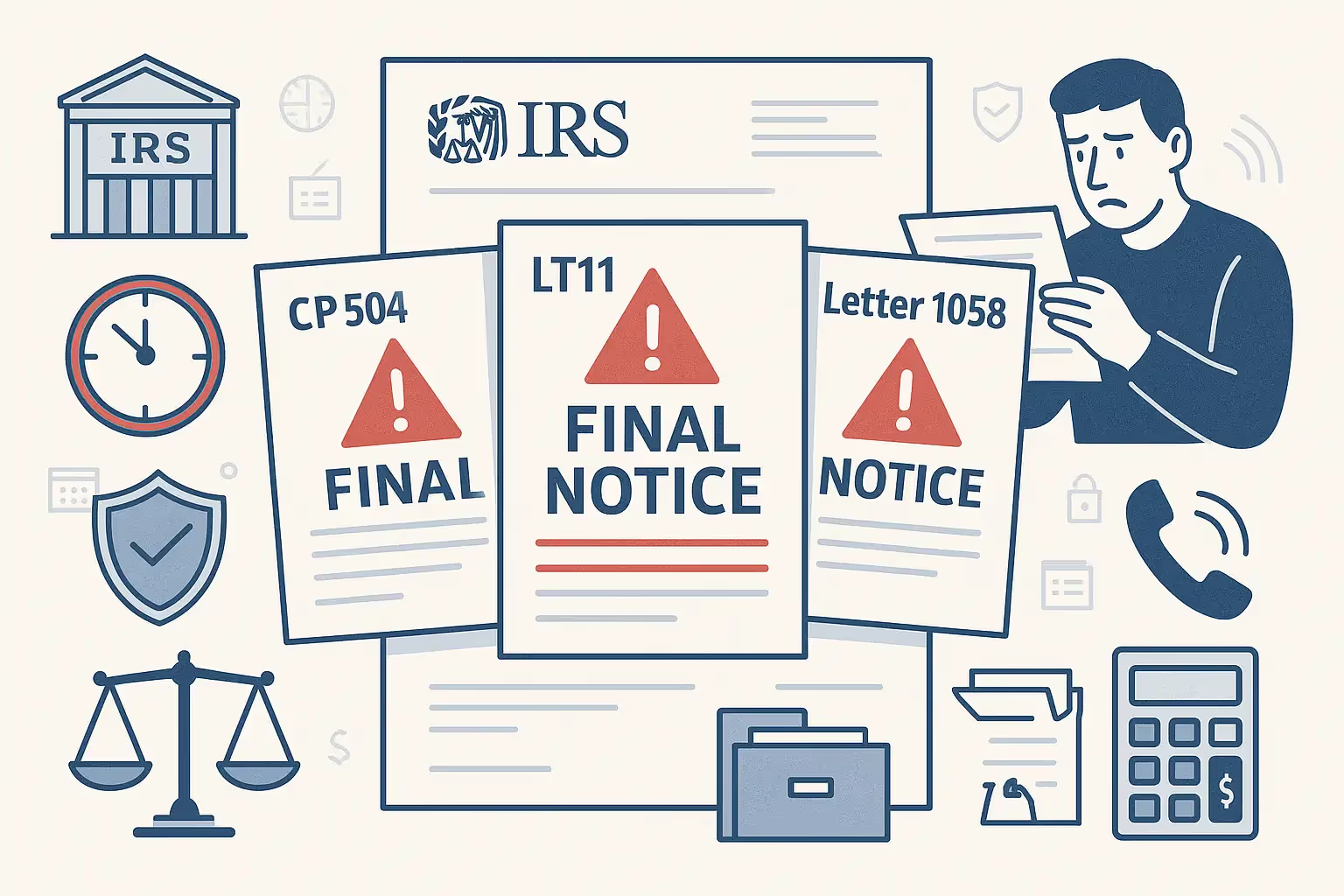

An IRS Offer in Compromise lets taxpayers settle their tax debt for less than the full amount owed. It provides a legal resolution, helps protect essential living funds, and offers a structured path to resolve overwhelming tax liabilities.

An IRS payment plan is one of the most effective defenses against bank levies when dealing with tax debt. By setting up a plan, taxpayers gain legal protection for their bank accounts while making manageable monthly payments. Acting quickly to establish an installment agreement helps preserve essential funds for living expenses and provides a structured path to resolve tax obligations.

IRS penalty abatement is a relief program that lets eligible taxpayers request removal or reduction of penalties for compliance failures. It helps save money and resolve tax liabilities, especially when circumstances beyond a taxpayer’s control prevented timely compliance.

An IRS Power of Attorney authorizes a qualified professional to act on your behalf in tax matters. It ensures protection during audits, disputes, and reviews by allowing experts to handle communication with the IRS. Without it, you must personally manage all interactions.

Innocent Spouse Relief protects individuals from unfair tax debt caused by a spouse’s errors on a joint return. It allows taxpayers to avoid sole responsibility for unreported income or incorrect deductions made by their partner, ensuring fairness in joint liability cases.

Payroll taxes are required withholdings from employee wages that fund Social Security, Medicare, and unemployment programs. They provide vital benefits for retirement, disability, and job loss. Employers must manage them accurately to avoid penalties and maintain employee trust.

Unfiled tax returns can result from financial, health, or paperwork challenges. However, delaying worsens consequences—penalties, substitute returns, and aggressive collection actions like wage or account garnishment.

A wage garnishment allows creditors or government agencies to take money directly from your paycheck to cover unpaid debts, such as taxes. If you are facing a garnishment, it is important to know that you have rights and options for relief.

While you are not required to hire a lawyer, professional help can be beneficial when responding to an IRS intent to levy. A tax professional can assist with forms, appeals, and negotiations. Legal or accounting support may improve your outcome in complex cases involving exempt income or hardship.

You can request a release if a levy causes immediate economic hardship by preventing you from paying basic living expenses. The IRS will review your income, expenses, and hardship documentation. They may remove the levy and label your account as Currently Not Collectible to pause further enforcement if approved.

The IRS can issue multiple tax levies if the balance remains unpaid. A levy only affects available funds when the bank receives the notice. If new deposits are made later, the IRS must send a new levy to access those funds. Repeated levies are associated with unresolved tax debt.

If you qualify for relief, the IRS generally processes levy releases within a few business days. You must contact the IRS, provide supporting documents, and request a formal review. Depending on your financial condition and the reason for the release, the process may involve a taxpayer advocate or a collections representative.

Ignoring a Notice of Intent to Levy allows the IRS to proceed with collection. In most cases, your bank account may be frozen and funds legally seized. You lose the right to request a hearing or propose payment alternatives. Prompt action is critical to avoid the consequences of enforced collection.

Yes, if your name is on a joint bank account and you can access the funds, the IRS levy may apply to the entire balance. Even if someone else contributed the funds, the IRS assumes shared control. The non liable party may file a claim to recover their share of the seized money.

A bank levy is a one-time legal seizure of funds already in your bank account, while wage garnishment is a recurring deduction from future income. The IRS uses both types of tax levies to collect unpaid tax debt, but levies affect existing assets, and garnishments apply to wages before they’re deposited.

Before transmitting, review each record carefully to confirm accuracy. Check that every individual taxpayer identification number and Social Security Administration record matches the issuer details. Following the step-by-step instructions provided by our team helps ensure each file is complete, compliant, and ready for submission.

Yes. The IRS encourages transmitters to use approved platforms and third-party transmitter services that follow official encryption and security protocols. This ensures that all filing information is transmitted securely and that filings comply with the IRS’s data protection requirements.

Once you obtain your TCC online, your application summary will show a completed status. You can then use this code to electronically file information returns through the IRIS or FIRE systems on behalf of your clients or business for the appropriate tax year.